Nearly three quarters of workers and 77% of retirees in a recent survey said they remain at least somewhat confident that they will experience a comfortable retirement, according to the Employee Benefit Research Institute. Nevertheless, a third of workers and a quarter of retirees felt less confident this year due to the economic effects of the COVID-19 pandemic, with many respondents citing inflation as the reason.

Nearly three quarters of workers and 77% of retirees in a recent survey said they remain at least somewhat confident that they will experience a comfortable retirement, according to the Employee Benefit Research Institute. Nevertheless, a third of workers and a quarter of retirees felt less confident this year due to the economic effects of the COVID-19 pandemic, with many respondents citing inflation as the reason.

Not surprisingly, those feeling less confident were also more likely to report poor health, lower income and saving rates, and higher debt. Women were much more likely than men to report lower confidence levels.

In the 2022 Retirement Confidence Survey, more retirees reported higher-than-expected expenses overall compared to 2021, with notable jumps in the housing and travel, entertainment, and leisure categories.

Despite these findings, 67% of workers and 72% of retirees were at least somewhat confident they will have enough money to keep up with the rising cost of living during retirement, and similar percentages were at least somewhat confident they would have enough money to last a lifetime. The majority of retirees said their retirement lifestyle has generally met their expectations, while a quarter actually said they’re experiencing a better-than-expected retirement.

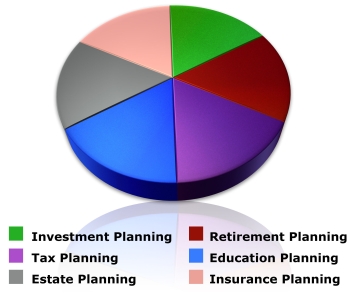

Top financial-planning priorities

When asked about their top three long-term financial-planning priorities, saving and investing for retirement made the list for both workers and retirees.

Workers

1. Saving and investing for retirement (59%)

2. Planning for future health and long-term care needs (36%)

3. Developing a strategy for drawing income in retirement (30%)

Retirees

1. Planning for future health and long-term care needs (48%)

2. Saving and investing for retirement (32%)

3. Being able to leave an inheritance to your children or other family members and developing a strategy for drawing income in retirement (tied at 31%)

Savings and confidence hurdles

The survey also highlighted a few challenges workers and retirees face when it comes to achieving a comfortable retirement. More than four in 10 workers said that college savings or payments are limiting how much they can save, and nearly half said that debt has had a negative impact. Similarly, more than a quarter of retirees said debt has hampered their ability to live comfortably.

Nearly four in 10 workers and two in 10 retirees do not know where to go for financial guidance. More than a third of workers and 21% of retirees said they rely on family and friends, while just 29% of workers and 38% of retirees said they work with a financial professional. Of those workers not currently working with a financial professional, 45% said they expect to do so in the future, up from 38% in 2021.

On the positive side, both workers and retirees who work with financial professionals said they were their most trusted resource.

For more information on this year’s Retirement Confidence Survey, please visit www.ebri.org.

All investing involves risk, including the possible loss of principal, and there is no guarantee that any investment strategy will be successful.

There is no assurance that working with a financial professional will improve investment results.

IMPORTANT DISCLOSURES

Altum Wealth Advisors does not provide investment, tax, or legal advice via this website. The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

CIRCULAR 230 NOTICE: To ensure compliance with requirements imposed by the IRS, this notice is to inform you that any tax advice included in this communication, including any attachments, is not intended or written to be used, and cannot be used, for the purpose of avoiding any federal tax penalty or promoting, marketing, or recommending to another party any transaction or matter.

Prepared by Broadridge Investor Communication Solutions, Inc. Copyright 2022.

Prepared for Altum Wealth Advisors

Steven Cliadakis, MBA, CFP®, AIF®, Managing Director, Financial Planner

Miste Cliadakis, CWS®, AIF®, Managing Director, Financial Planner

Losing a loved one can be a difficult experience. Yet, during this time, you must complete a variety of tasks and make important financial decisions.

Losing a loved one can be a difficult experience. Yet, during this time, you must complete a variety of tasks and make important financial decisions. Initial tasks

Initial tasks The 2015 Budget Bill, signed into law on November 2nd, will put an end to two popular Social Security claiming loopholes associated with the restricted application and file-and-suspend claiming options.

The 2015 Budget Bill, signed into law on November 2nd, will put an end to two popular Social Security claiming loopholes associated with the restricted application and file-and-suspend claiming options.